The employee portion of Social Security tax deferred in 2020 under Notice 2020-65, as modified by Notice 2021-11, that is withheld in 2021 and not reported on the 2020 Form W-2 should be reported in box 4 (Social security tax withheld) on Form W-2c, Corrected Wage and Tax Statement. However, do not include in box 4 (Social security tax withheld) any amount of deferred employee Social Security tax that was not withheld in 2020.

If you deferred the employee portion of Social Security tax under Notice 2020-65, as modified by Notice 2021-11, when reporting total Social Security wages paid to an employee on their 2020 Form W-2, Wage and Tax Statement, include any wages for which you deferred withholding and payment of employee Social Security tax in box 3 (Social security wages) and/or box 7 (Social security tips). In response, Treasury and the IRS issued Notice 2021-11 modifying Notice 2020-65 to provide that the due date to withhold and pay the deferred amount of the employee portion of Social Security tax is postponed until the period beginning on Januand ending on December 31, 2021. Section 274 of the COVID-related Tax Relief Act of 2020, enacted on December 27, 2020, as part of the Consolidated Appropriations Act, 2021, extended the end of the time period during which employers must withhold and pay the amount of the deferred Social Security tax from April 30, 2021, to December 31, 2021. To pay the deferred amount of the employee portion of Social Security tax, Notice 2020-65 provided that the employer was required to ratably withhold the amount of Social Security tax deferred from the employees' paychecks from Januthrough April 30, 2021. Notice 2020-65 provides employers with the option to defer the employee portion of Social Security tax from Septemthrough December 31, 2020, for employees who earn less than $4,000 per bi-weekly pay period (or the equivalent threshold amount with respect to other pay periods) on a pay period-by-pay period basis. In response to the Presidential Memorandum, Treasury and the IRS issued Notice 2020-65 on August 28, 2020.

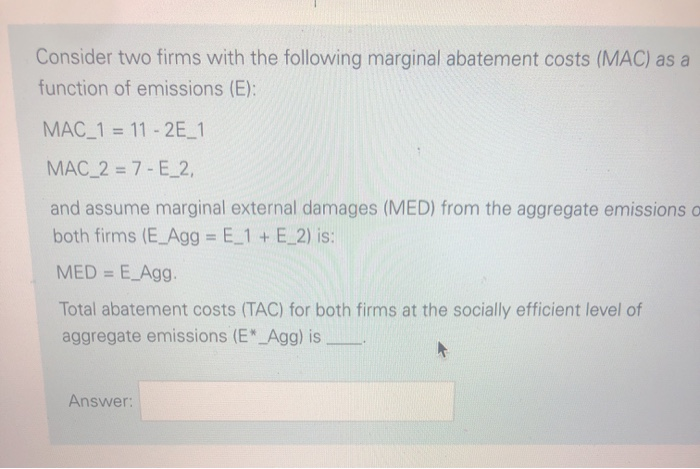

SOLVE MAC FOR 2 FROM TAC FOR 2 COMPANIES CODE

On August 8, 2020, a Presidential Memorandum was issued, directing the Secretary of the Treasury to use his authority pursuant to section 7508A of the Internal Revenue Code to defer the withholding, deposit, and payment of certain payroll tax obligations.

0 kommentar(er)

0 kommentar(er)